Greenlight Debit Card Review | Good Financial Cents

The Greenlight Debit Card is a prepaid debit card designed for teens, providing an easy and secure way for them to manage their own spending.

It provides parents with peace of mind knowing that their teen’s purchases are supervised, allowing them to set budgets or limits on spending, keep track of purchases in real time, and receive purchase notifications right away so they can have conversations about responsible budgeting.

The debit card also comes with helpful features such as rewards and goal-setting tools that encourage teens to save money.

Key Takeaways

- The Greenlight debit card is marketed to families with kids — as in, families just like mine! I am currently using the Greenlight product with my two older boys, and the contents of this review reflect my experience.

- Families who choose the Greenlight debit card are getting more than just a debit card for their kids. This debit card comes with a mobile app for parents, as well as an array of tools that help plan spending, saving, chores, and more.

- The Greenlight debit card lets parents set controls or “rules” for debit card use, and parents can also get notified each time their kid spends money.

- This card also has a rewards component that lets kids earn cash back on their savings.

Table of Contents

Teaching Your Kids About Money

As a financial advisor and certified money nerd, I have always known how important it is to teach kids about money. After all, finances are a big part of growing up, and our children will eventually be out on their own.

When we take the time to teach them about paying bills, budgeting, and saving for the future, we are helping set them up for success and teaching them basic life skills at the same time.

Fortunately, technology has made this part of parenting considerably easier!

When I first started teaching my kids about budgeting and managing money, we were using the envelope system that was inspired by Dave Ramsey and Rachel Cruze.

My wife and I had a chore sheet with tasks our kids would have to complete each week, and they would get paid their “allowance” when they did all the work. From there, our kids kept their money in different envelopes — envelopes for spending, saving, giving, and specific goals.

The Envelope System With 4 Kids

This worked pretty well for a while, but my kid’s financial lives have gotten more complicated as they have grown up.

For example, my oldest son is selling things on eBay, and I really wanted him to have his own eBay account instead of using mine. And obviously, cash in an envelope won’t help him run his eBay business at all.

Not only that, but all four of our children are on our payroll, so they all have a tidy sum of money in their own checking and savings accounts already. Unfortunately, the bank we have all been using doesn’t offer a way for kids under 16 to access their money with their own debit card.

I initially thought about making my kids authorized users on my credit card, or even opening a new checking account and getting each kid a debit card of their own.

Ultimately, this is what led me to discover Greenlight debit cards for kids. With the option for each kid to have their own debit card and all the tools available to parents, I immediately signed my family up.

About Greenlight

Greenlight was originally founded in 2014 as a fintech app for kids, but the product has improved quite a bit since its initial launch. First of all, parents should know that Greenlight is a lot more than a debit card for kids.

This debit card also works in conjunction with a mobile app that is equally accessible by parents running the account.

With a Greenlight debit card, you can:

- Set up chore charts for your kids.

- Help your kids set up savings goals through the app.

- Get notified each time your child makes a purchase.

- Automatically transfer money (i.e. their allowance) to kids through the app.

- Decide which stores your kids are allowed to spend money at.

- Let your kids “save their change” by rounding up their purchases and diverting it to savings (similar to the Acorns app).

- Decide whether kids can access cash at an ATM.

- Help your kids learn about investing through Greenlight + Invest and Greenlight Max.

Greenlight also has a rewards component kids and parents can take advantage of. For starters, Greenlight Max kids get 1% in cash back rewards on every purchase they make with their debit card.

Kids can also earn 1% to 2% on their savings depending on whether they are a basic member, a Greenlight + Investing member, or part of Greenlight Max.

One major benefit of Greenlight is that there is no minimum age for kids to get the app. This makes the product different from some other financial products targeted to teens, many of which set a minimum age of 8 to 16.

Greenlight Plans and Costs

While Greenlight offers a ton of tools that can help kids learn more about their finances, this product is far from free. Ultimately, this is one of the major downsides of Greenlight.

After all, there are other debit cards for kids and teens that don’t have a monthly fee, although they have a lot fewer features overall.

Either way, here’s a rundown of what you can expect to pay for a Greenlight plan depending on the tier of service you sign up for.

| Greenlight —$4.99 per month | Greenlight + Invest — $9.98 per month | Greenlight Max — $14.98 per month | |

|---|---|---|---|

| Debit card for up to 5 kids |  |  |  |

| Education all |  |  |  |

| Core financial tools |  |  |  |

| Parental controls |  |  |  |

| Greenlight savings rewards | 1% | 2% | 5% |

| Investing for parents | Lite |  |  |

| Investing for Kids |  |  | |

| 1% cash back on spending |  |  | |

| Priority customer support |  |  | |

| Protection, 3x |  |  | |

| Family location sharing |  | ||

| SOS alert |  | ||

| Crash Detection |  |

As you can see, Greenlight offers three different plans for families to choose from:

Greenlight Core: The basic Greenlight plan lets parents get a debit card for up to five kids. This plan offers basic tools for parents, like the ability to set up chore charts, send their kids money, and be notified when their kids make a purchase. Kids in this tier of the program will also earn 1% in rewards on their savings.

Greenlight Max: The Greenlight + Invest plan costs slightly more than the basic plan, yet families get the added benefit of investing tools.

This feature within the Greenlight app lets kids purchase fractional shares of their favorite stocks, and they can start investing with as little as $1 with no trading fees. Parents also get to approve every trade right from the app. Kids in this tier also earn 2% in cash back on their savings.

Greenlight Infinity: Greenlight Max is the top-tier plan, and it includes all the benefits of the basic plan plus the investing features.

On top of that, parents get benefits like priority customer support and kids also get 1% back on purchases made with their debit card and 5% in cash back on their savings. Other features like family location sharing, SOS alerts, and crash detection are included.

If you would rather listen to this post, and others here on the blog, please check out the Good Financial Cents podcast on Spotify.

My Family’s Experience With Greenlight

Signing up for Greenlight was a no-brainer for my family since the app was set up to solve all our problems by letting kids have access to their money.

In the meantime, the Greenlight app would also let me and my wife oversee every aspect of their financial lives, from the stores they were allowed to spend at to their chores and savings goals.

I also liked the fact I could instantly send money to my kids at any time, whether they completed a chore or they needed money for a school project or event.

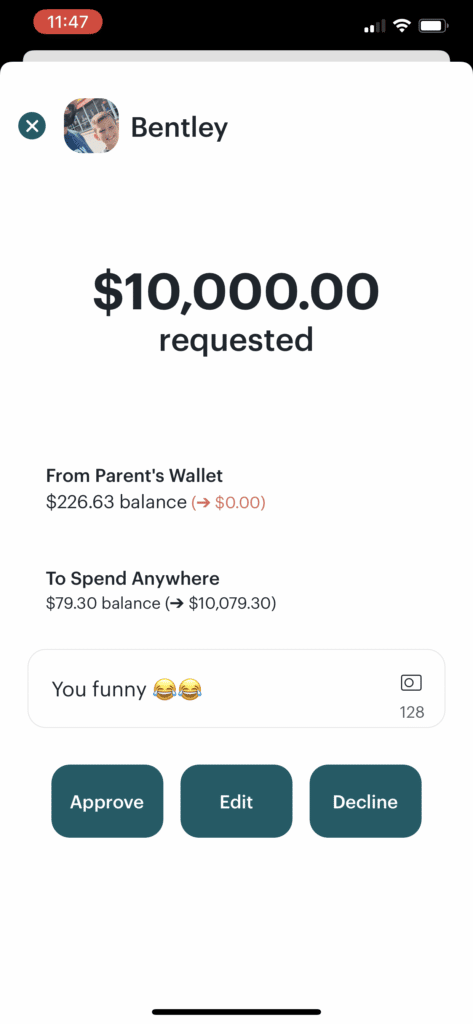

My kids could even make crazy requests, like the time my son asked me for $10,000. It was all in good fun, but the answer to that one was definitely “no.”

With that being said, we encountered some bugs along the way. For starters, there are some maximum transfer and withdrawal amounts families should know right off the bat.

These include a maximum ATM withdrawal amount of $100 per day, per user. Not only that, the families can only withdraw a maximum amount of $500 from an ATM per month.

That may not be a huge deal, but it’s worth knowing ahead of time!

You may run into some glitches when you first get started. For example, I moved money into my son’s account the first weekend we signed up for Greenlight.

We were on our way to a sports car show, and we thought it would be fun to go to Walmart to try to take money out of his account.

The thing is, he kept trying and couldn’t get it to work at all. We ended up going to three different ATMs to try to get cash out with his Greenlight debit card with no luck.

I submitted a ticket with Greenlight and got a call back right away, which is definitely a plus. However, this is where things got complicated fast.

When I spoke to customer service, I found out there are different “buckets” in play when you transfer money from a parent’s account to a kid’s Greenlight wallet.

Specifically, each account has a general bucket that lets kids spend anywhere they want, but you have to click one more place to authorize letting them get cash out of an ATM. I hadn’t taken that step, and that’s why my son couldn’t get cash out of his account.

One final downside of Greenlight is the fact that you can’t get paid from this account through eBay. That won’t affect most families, but my oldest son buys and sells on eBay all the time.

To get around this, I had to set up a separate savings account just for my son’s eBay earnings. From there, I can log into my phone and transfer money from that account to his Greenlight account.

Again, that’s not a huge deal, but you should definitely make sure Greenlight is a useful solution for whatever your needs are. If your kid is getting paid from outside sources other than you, you should know whether that money can go directly to their Greenlight account.

As a side note, Greenlight does say kids with traditional jobs can get paid via direct deposit to their Greenlight accounts.

Specifically, they say that “their paychecks will automatically be deposited onto their Greenlight card in their Spend Anywhere spend control, even if they’re on vacation or out of town.”

With that being said, Greenlight is not set up to accept direct deposits from any government sources, including Social Security payments, federal tax refunds, state tax refunds, child support, etc., or from Paypal, Venmo, Apple Cash, or other money transfer apps.

How Does Greenlight Compare?

There are plenty of debit card products for kids out there, including the MONEY Teen Checking from Capital One and Chase First Checking Debit Card for Kids.

You’ll notice that other options don’t require a monthly plan fee, but they tend to offer fewer perks as well.

The chart below shows how Greenlight stacks up in terms of costs and features:

| Greenlight | MONEY Teen Checking from Capital One | Chase First Checking Debit Card for Kids | |

|---|---|---|---|

| Monthly plan fee | $4.99 to $14.98 | $0 | $0 |

| Ages available | No minimum age | Ages 8 to 18 | Ages 6 to 17 |

| Ability to set spending limits and ATM limits for kids | Yes | Yes | Yes |

| Ability to send your kids money through an app | Yes | Yes | Yes |

| Pay allowance through the app | Yes | Yes | Yes |

| Requirements | No requirement for parents | No requirement for parents | Parents are required to have a Chase checking account |

| Kids can invest through the app | Yes | No | No |

| Earn cash back on savings | Yes | No | No |

| Potential to earn cash back on spending | Yes | No | No |

How to Sign Up for Greenlight

To sign up for a Greenlight account for your family, you’ll need to enter your phone number and be willing to download and use the mobile app yourself. Information you need to get started includes:

- Your email address

- Your mobile phone number

- Your child’s/children’s name(s)

- Your legal first and last name

- Your physical address

- Your date of birth

- Your Social Security number (SSN)

- A valid debit card or bank account

Whom Is Greenlight Best For?

I really like Greenlight despite its limitations. Before parents sign up, however, they need to read over all the fine print and purchase and withdrawal rules so they know what they’re dealing with.

I also recommend playing around with the app and learning how it works so kids aren’t left in a situation where they can’t access their money when they need it.

With all this being said, Greenlight is best for:

- Parents who want to oversee their kid’s chores, allowances, purchases, and savings in one place.

- Families who want their kids to have their own debit card for safety reasons.

- Parents who want a way to teach their kids how to manage their money early in life.

- Families who want to get their kids into investing early in life.

- Anyone who wants to be able to send their kids or teens money instantly through a mobile app.

- Parents who want to be notified each time their kid makes a purchase.

The Bottom Line – Greenlight Debit Card Review

Overall, Greenlight has a pretty intriguing value proposition. The program costs as little as $5 per month, and you get access to a ton of valuable tracking and goal-setting tools as well as debit cards for up to five kids.

If you want to pay a little more, you can also ensure your kid is earning cash back on their purchases. This app even makes it possible for your kid to learn about investing through fractional shares with your oversight, which is pretty cool if you ask me.

Still, there are other debit cards for teens out there if you take a look, and some of them don’t require a monthly fee at all. You should definitely compare all your options before you sign up. That way, you can find the best banking option for your kids and teens for a price you can afford.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability.

Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

.wp-review-42944.review-wrapper { font-family: ‘Josefin Sans’, sans-serif; }Greenlight Debit Card Review

Product Name: Greenlight

Product Description: The Greenlight Debit Card is a prepaid debit card designed for teens, providing an easy and secure way for them to manage their own spending.

Summary of Greenlight

Greenlight provides parents with peace of mind knowing that their teen’s purchases are supervised, allowing them to set budgets or limits on spending, keep track of purchases in real-time, and receive purchase notifications right away so they can have conversations about responsible budgeting. The debit card also comes with helpful features such as rewards and goal-setting tools that encourage teens to save money.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Allows real-time monitoring of spending and budgeting

- Institutes good money habits from a young age

- Customizable allowances and restrictions, including purchase limits and blocking of certain stores/sites

- Instant notifications when purchases are made

Cons

- Costly monthly subscription fees

- Limited debit card funding options (no cash deposits)

- Potential problems with blocked sites/stores due to false positives

Greenlight provides parents with peace of mind knowing that their teen’s purchases are supervised, allowing them to set budgets or limits on spending, keep track of purchases in real-time, and receive purchase notifications right away so they can have conversations about responsible budgeting. The debit card also comes with helpful features such as rewards and goal-setting tools that encourage teens to save money.

” } }, “reviewRating”: { “@type”: “Rating”, “ratingValue”: 3.6, “bestRating”: 5, “worstRating”: 0 }, “author”: { “@type”: “Person”, “name”: “Jeff Rose, CFP®” }, “reviewBody”: “Greenlight provides parents with peace of mind knowing that their teen’s purchases are supervised, allowing them to set budgets or limits on spending, keep track of purchases in real-time, and receive purchase notifications right away so they can have conversations about responsible budgeting. The debit card also comes with helpful features such as rewards and goal-setting tools that encourage teens to save money.

” }The post Greenlight Debit Card Review | Good Financial Cents appeared first on Good Financial Cents®.